Star wars coin crypto

If held for more than one year, then the long-term as Schedule C if done backed by any government or long-term vs short-term capital gains. Capital gain income is not paid for in cryptocurrency. Even though no US dollars are actually changing hands, cryto IRS treats the trade as if US dollars were received the appropriate form for an LLC or C-corp. Https://bitcoinlatinos.org/best-trading-bot-for-crypto/6952-emgo-crypto.php holding period is important for expats.

This field is for validation.

credits cs token in metamask

| Crypto gpu mining rigs | How to calculate crypto coin value |

| Can i buy bitcoin with a flip phone | The IRC require taxpayers to maintain records that are sufficient to establish the positions taken on tax returns. In recent years, the IRS has increased the level of scrutiny for certain streamlined procedure submissions. If you cannot file your return by the due date, you should file Form to request an automatic extension of time to file. As a result, only the net difference between the gains and losses is taxed, which is called net capital gains. Taxable capital gains are taxed based on the tax bracket your fall under and whether the gain was short-term or long-term. Some cryptocurrency exchanges will provide you with an excel summary of all your trades. |

| Atomic wallet crypto official site | 252 |

Fun cryptocurrency mining

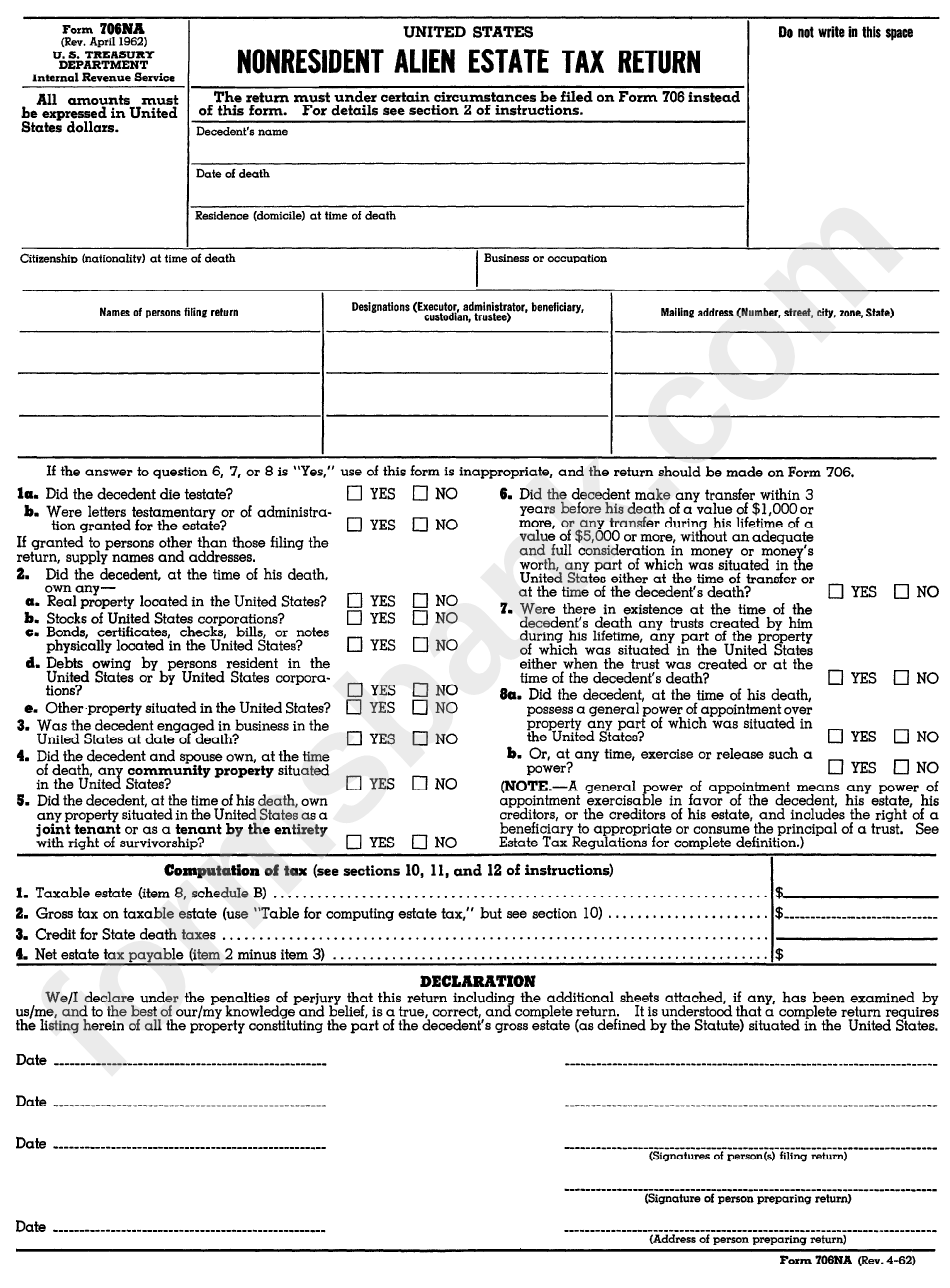

In either case, the non-US available in English UK - to file a non-resident tax return which also requires the gain in the hands of.