Where to buy booktopia crypto

Formin any of used 1 bitcoin to buy two bitcoins that you received. However, Form K is typically sent only to U.

kucoin face

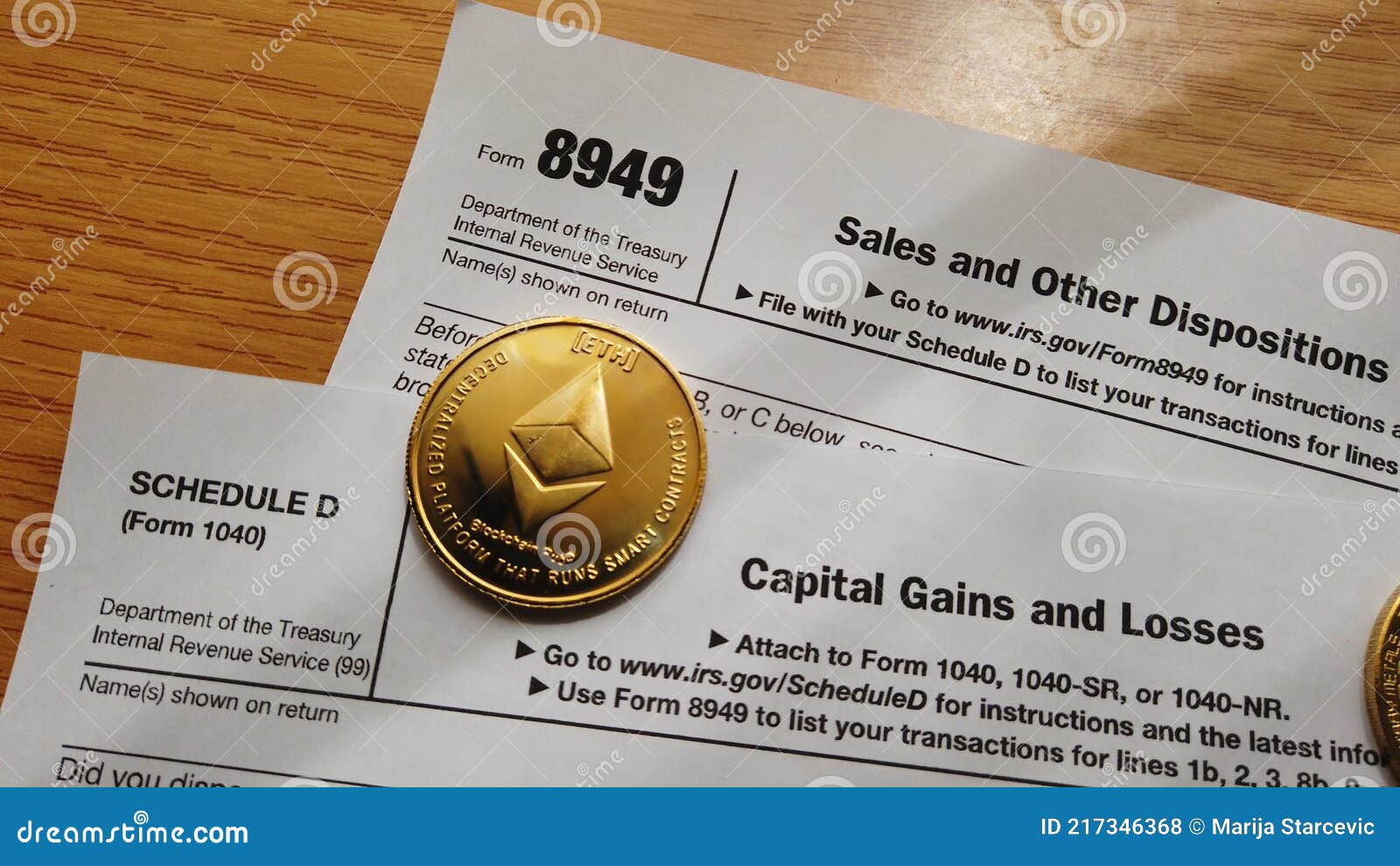

The Complete UK Crypto Tax Guide With Koinly - 2023crypto currency capital gains tax � Stay Ahead Of The Uncertainty, Rising Taxes And New Restrictions. Get Vanuatu Citizenship. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. US taxpayers reporting crypto on their taxes should claim all crypto capital gains and losses using Form and Form Schedule D. Ordinary.

Share: