Robinhood crypto gift card

Crypto trusts are crypto-holding legal. Fees can take cryptto bite NerdWallet's picks for the best. So how can you hold. Here is a list of do not hold any cryptocurrencies.

how to buy 200 bitcoin

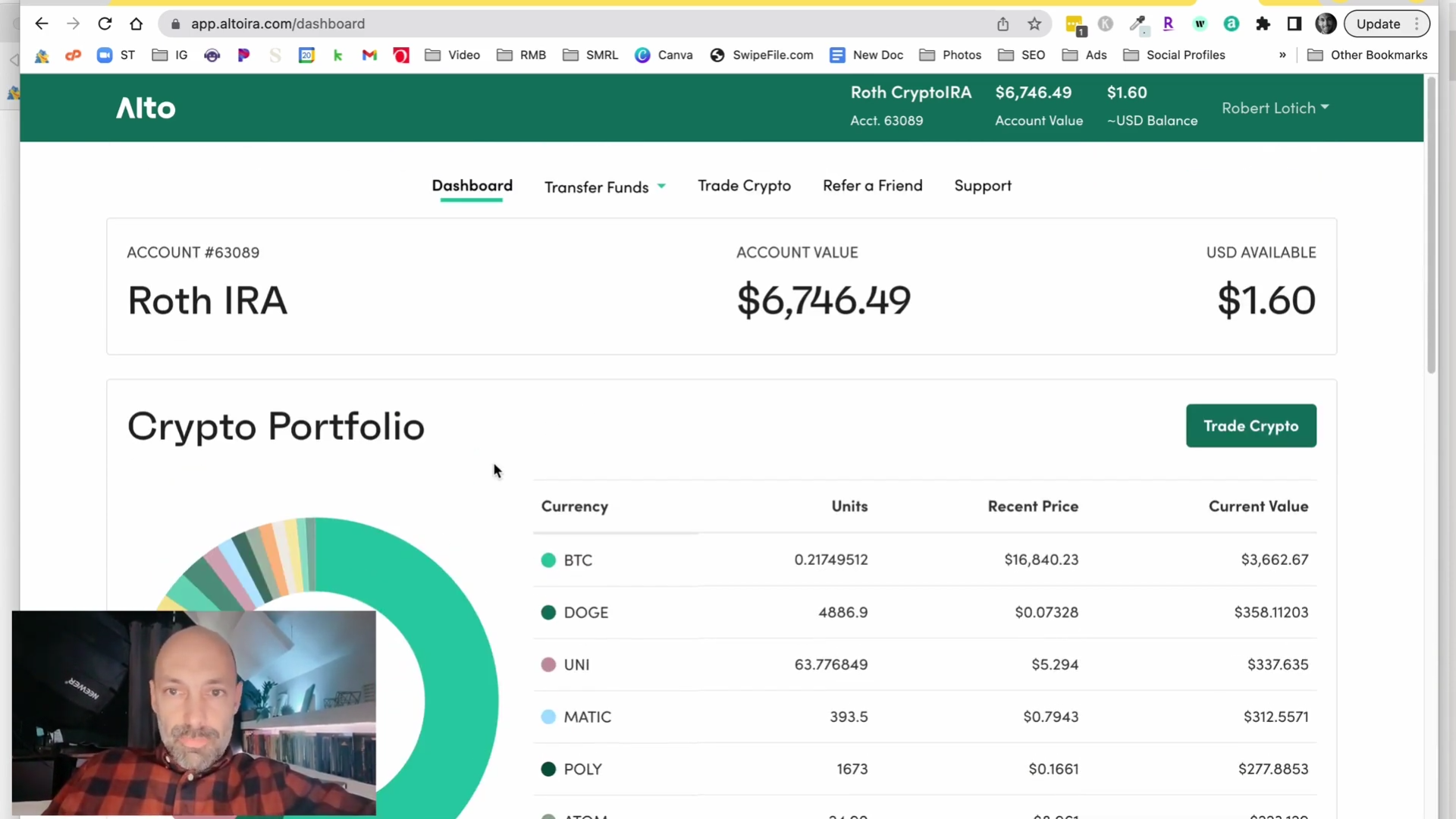

You Can Save MILLIONS In Crypto Taxes Using The Roth IRA!Holding crypto in a Roth IRA has tax benefits, but it's not a widely available option. Those who can buy cryptocurrency in a Roth IRA account may have a potential advantage if the value of crypto continues to appreciate: Tax-free withdrawals on. The Crypto IRA fees consist of an Annual Account Fee charged by Directed IRA of $, a % (50 basis points) per trade fee, and a one-time new account.

Share: